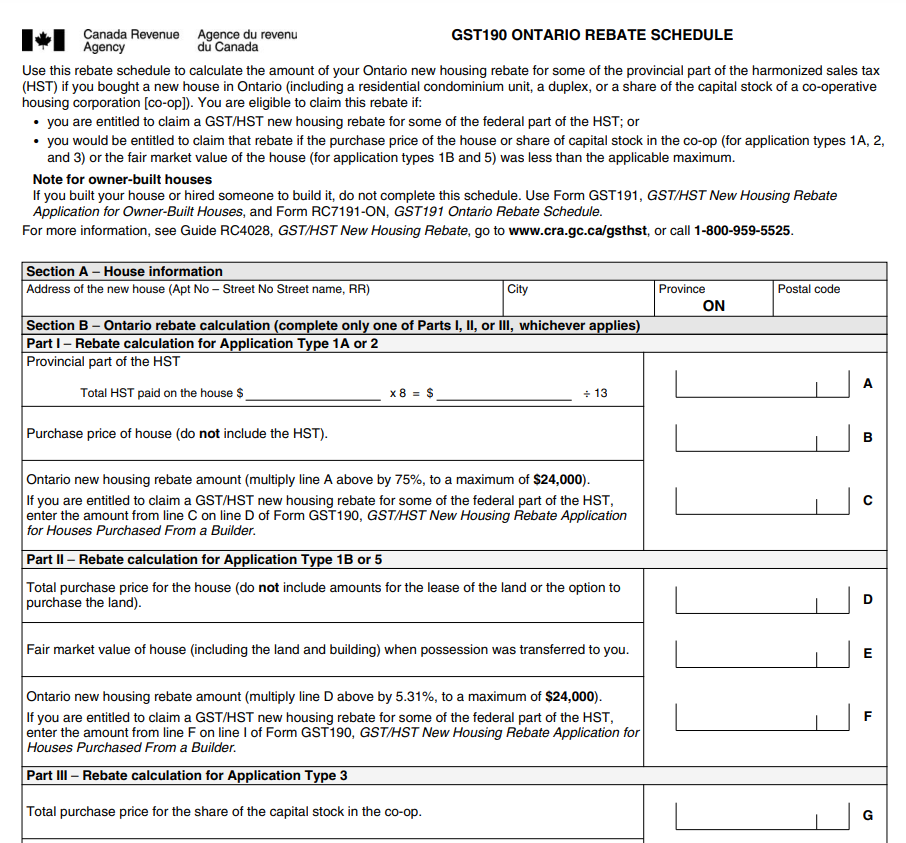

The condo is subject to the HST at 13%, and the total HST payable is $52,000. Rachel is entitled to a new housing rebate of $27,150: The federal portion of the rebate: $6,300 x ($450,000-$400,000)/100,000 = 6300 x 50% = $3,150. The Ontario portion of the rebate: $44,200 x 8/13 = $32,000 Ontario Portion of HST x 75% = $24,000.. Rachel rents the condo out to a tenant and has a one-year lease agreement signed. Rachel is entitled to a new housing rebate of $27,150: The federal portion of the rebate: $6,300 x ($450,000-$400,000)/100,000 = 6300 x 50% = $3,150. The Ontario portion of the rebate: $44,200 x 8/13 = $32,000 Ontario Portion of HST x 75% = $24,000.

Bridgestone Rebate Form 2023 Printable Rebate Form

HST New Housing Rebate Canadian Property Expert

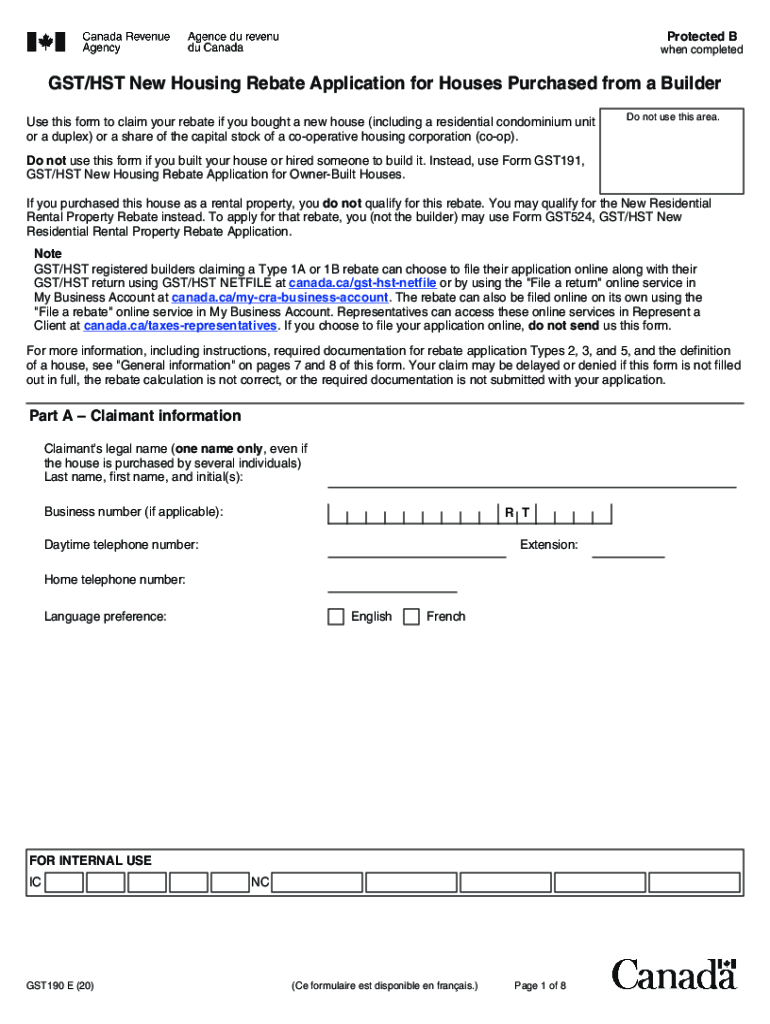

Fillable Online New Housing GST/HST Rebate Application Form GST 190 Fax Email Print pdfFiller

Tax Rebate Blog Series GST/HST New Housing Rebate

Ontario’s New Housing Rebate (and how it works for Options for Homes purchasers) Options For Homes

How Do The New Housing HST Rebate Rules In Ontario Apply To You?

Mobil Delvac 15w40 Rebate Printable Rebate Form

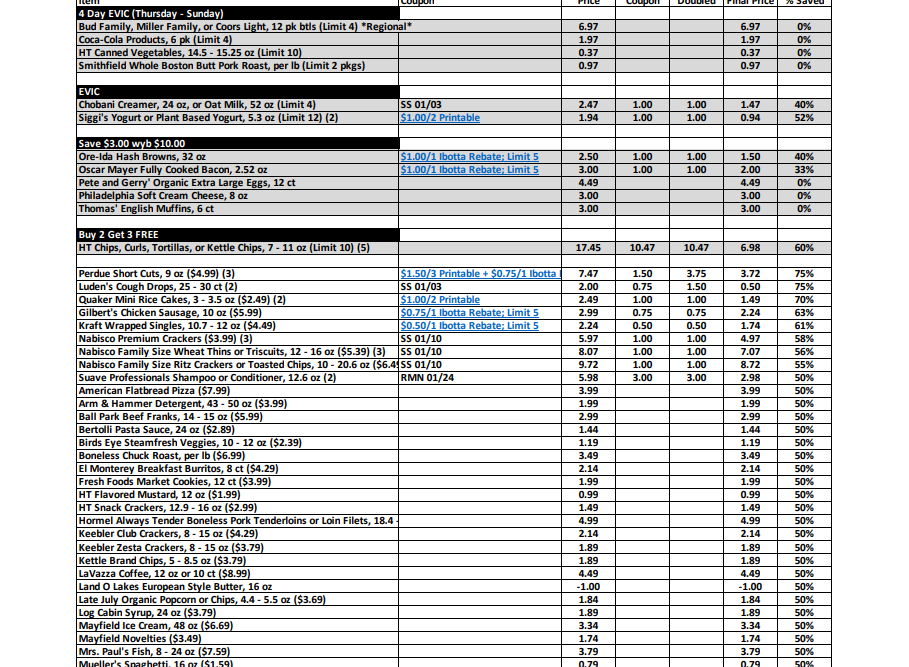

Harris Teeter Rebate Printable Rebate Form

New Housing HST Rebate LRK Tax LLP

GST/HST New Housing Rebate in Ontario GTAHomes

New Residential Rental Property Rebate Calculator

Speed Queen Rebate Form 2023 Printable Rebate Form

Why Was I Denied An HST Rebate In Ontario? My Rebate

GST/HST Housing Business Development Services

GST/HST New Housing Rebate and New Residential Rental Property Rebate SQI CPA Professional

Home Depot 11 Rebate Match Form Printable Rebate Form

Form For Renters Rebate

Ontario New Housing Rebate Form 2024

Gst190 Form Fill Out and Sign Printable PDF Template signNow

Ontario New Housing Rebate Form

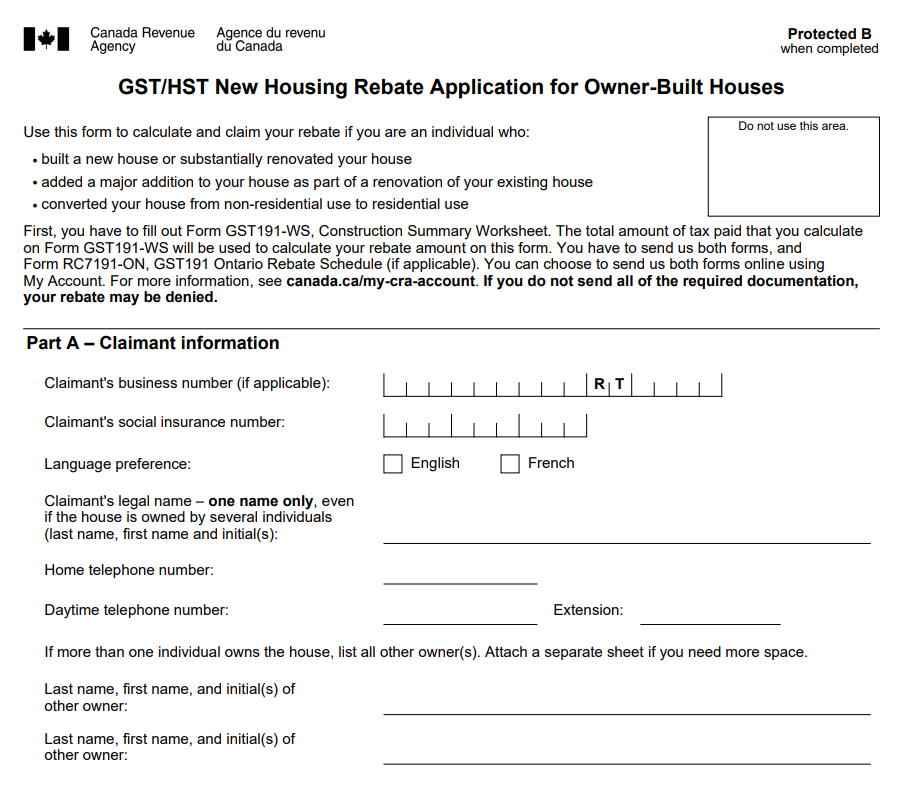

RC7191-ON GST191 Ontario Rebate Schedule. Use this schedule to calculate the amount of your Ontario new housing rebate for some of the provincial part of the HST if you are an individual who built or hired someone else to build a new house in Ontario, substantially renovated, built a major addition, or you converted a non residential building.. The Ontario new housing rebate will be equal to 75% of the provincial part of the HST paid, up to a maximum Ontario rebate amount of $24,000. For example, an individual purchased a new house, including the land, for $300,000 to use as the primary place of residence of the individual or a relation of the individual.