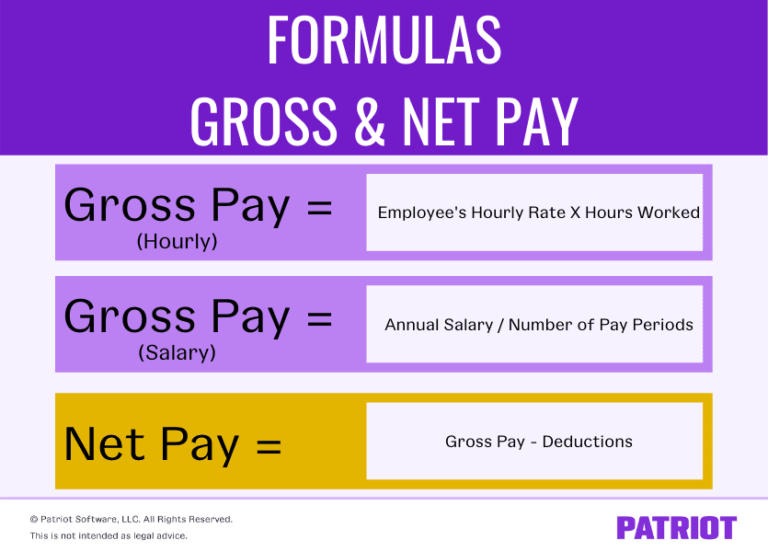

Gross pay, called gross wages or gross income, is the salary or hourly rate an employer pays an employee. Gross pay reflects what the employee earns before deductions, such as local, state, and.. If you're a salaried employee, your gross pay is your annual salary divided by the number of pay periods per year. So if you earn $60,000 annually and get paid biweekly, your gross pay per paycheck would be: $60,000 / 26 (bi-weekly pay periods per year) = $2,307.69 per paycheck. To calculate gross pay for an hourly employee, you will multiply.

Gross Pay Vs Net Pay Understanding and Calculating the Difference

GROSS Vs NET Differences Between Net Vs Gross You Must Know! 7 E S L

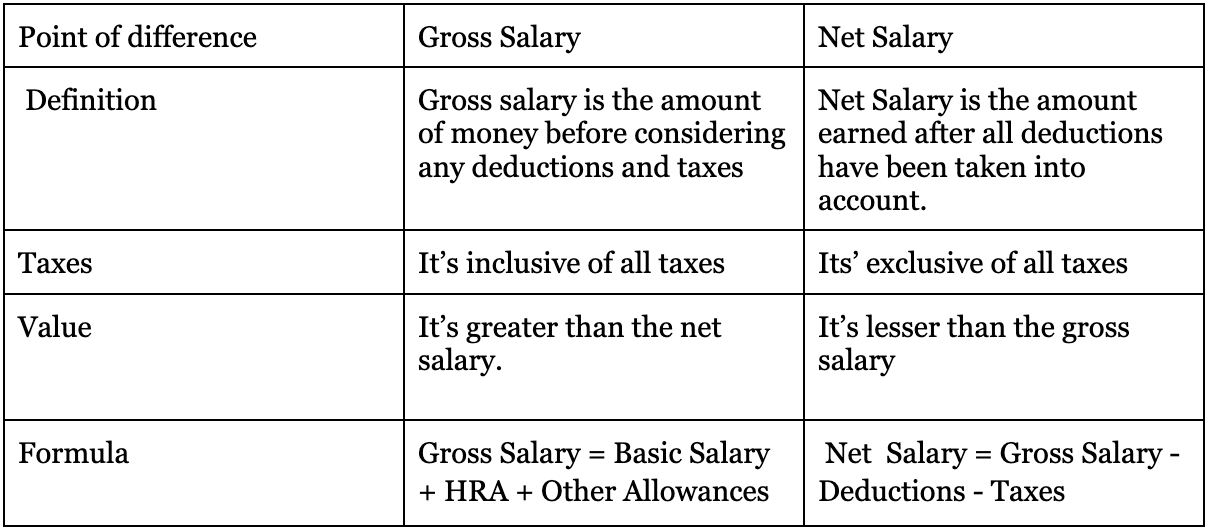

Gross Salary Vs Net Salary Major Comparison & Difference Between Gross & Net Salary

Gross Pay vs. Net Pay What’s the Difference Between Them? Gusto

Gross Pay vs. Net Pay A Deep Dive to Help Simplify Payroll

Gross vs. Net Pay What's the Difference?

Gross Pay vs Net Pay Is Gross Before or After Taxes? Money Bliss

Gross Pay vs Net Pay How to Budget Your The Right Way

Gross vs. Net Differences and How to Calculate Each MintLife Blog

Gross vs. Net

Gross Salary vs. Net Salary What are the main differences?

Gross Pay vs Net Pay What’s the Difference and How to Calculate Both Wrapbook

How to Calculate Your Net Pay from Your Gross Pay

What is the Difference Between Gross Salary and Net Salary?

gross vs. net pay visual definitions

Gross Pay vs. Net Pay What’s the Difference Between Them? Gusto

Gross Pay Vs. Net Pay What’s the Difference? APS Payroll

Understanding Gross Pay Vs. Net Pay

What is the difference between gross and net pay Early Retirement

Differences Between Gross & Net Pay Fingercheck

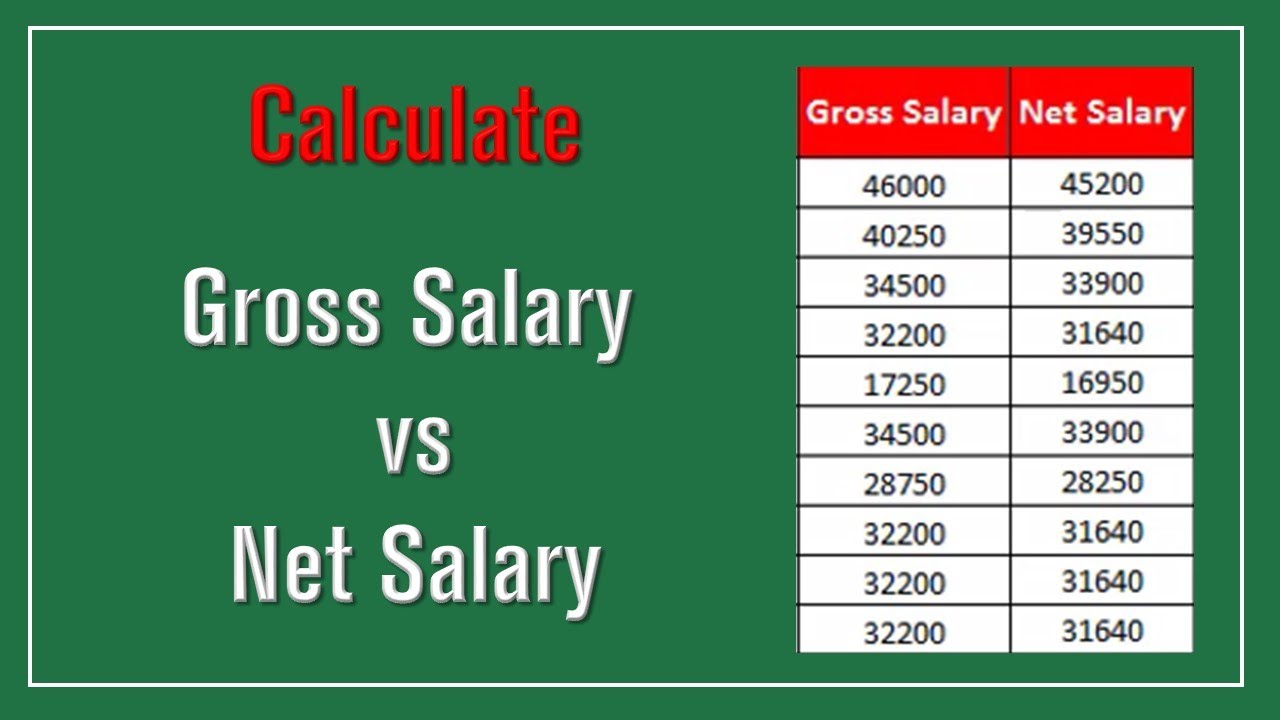

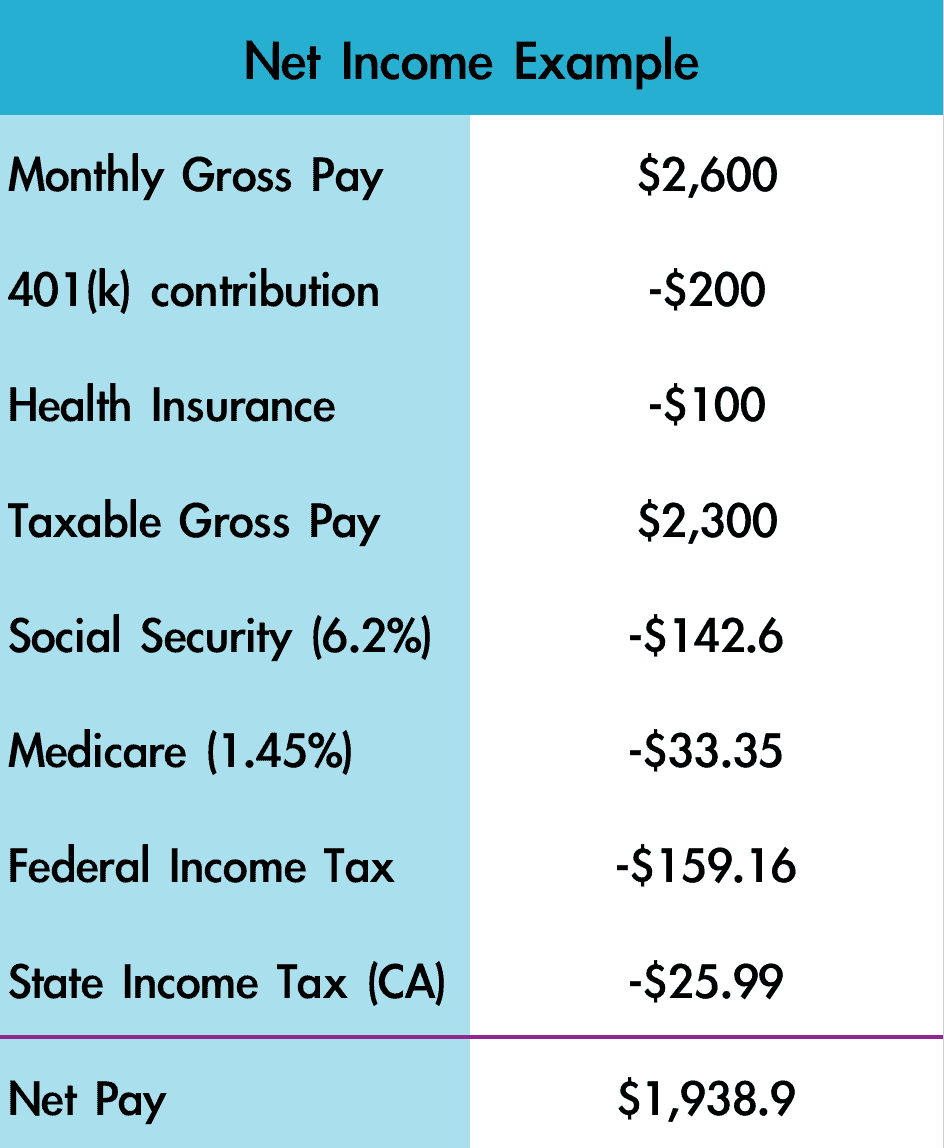

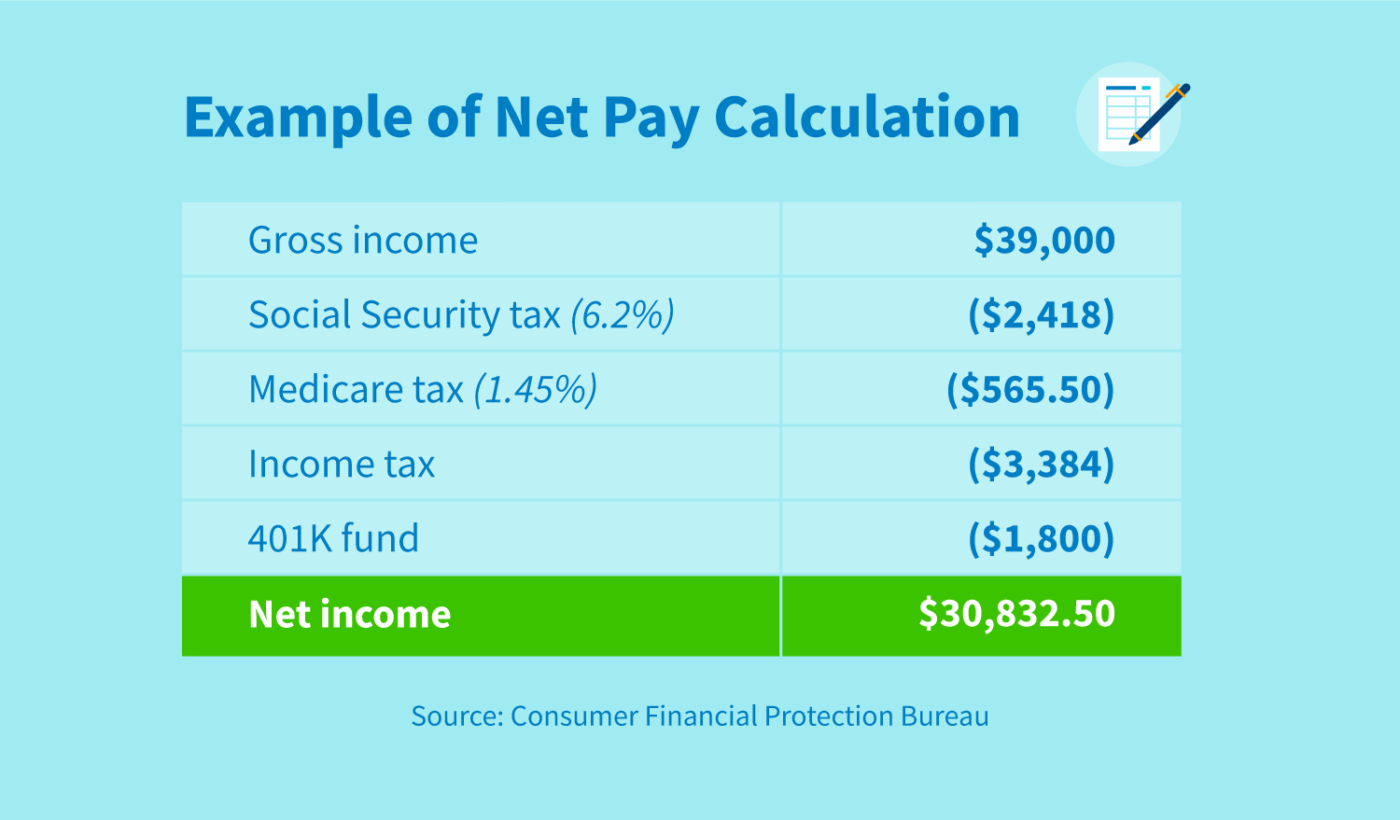

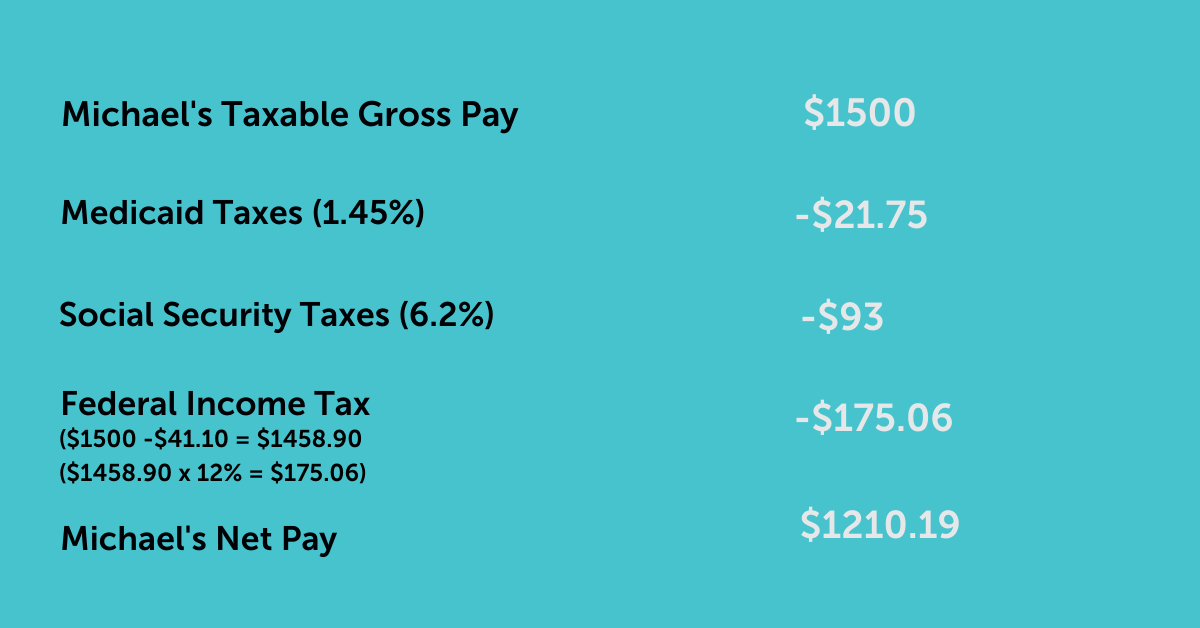

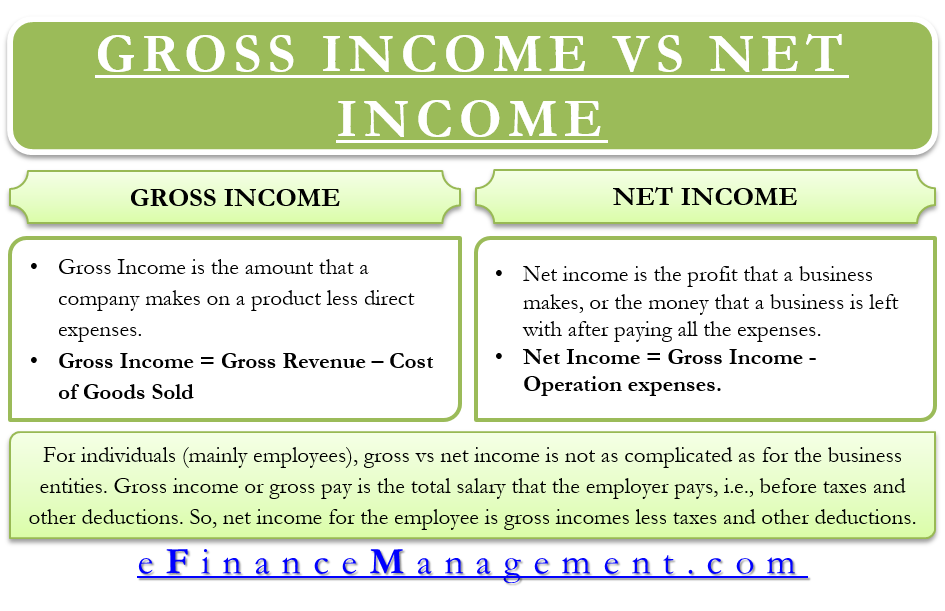

For example, if the employee earns $81,000 in gross pay on an annual basis and is paid monthly, they would divide $81,000 by 12 to find their gross income per pay period. This would equal $6,750.. The formula to calculate is this: Gross pay - voluntary and mandatory deductions = net pay. For example, if you have an employee that makes $2,600 in gross wages biweekly but deductions each pay period equals $800, their net pay each paycheck will be $1,800. Every employee's net pay will be different.